MSME stands for micro, small and medium enterprises, and these are the backbone of any developing economy. To support and promote MSMEs, the Government of India through various subsidies, schemes and incentives promote MSMEs through the MSMED Act.

To avail the benefits under the MSMED Act from Central or State Government and the Banking Sector, MSME Registration is required. For ( )

The registration scheme has no statutory basis. Units would normally get registered to avail some benefits, incentives or support given either by the Central or State Govt.

msme small scale industries BENEFITS OF MSME/SSI REGISTRATION

1. Easy finance availability from Banks, without collateral requirement. 2. Protection against delay in payment from Buyers and right of interest on delayed payment. 3. Preference in procuring Government tenders. 4. Stamp duty and Octroi benefits. 5. Concession in electricity bills. 6. Reservation policies to manufacturing / production sector enterprises. 7. Time-bound resolution of disputes with Buyers through conciliation and arbitration. 8. Reimbursement of ISO Certification Expenses. 9. Credit prescription (Priority sector lending), differential rates of interest etc. 10. Excise Exemption Scheme. 11. Exemption under Direct Tax Laws. 12. Stamp duty and Octroi benefits. 13. Statutory support such as reservation and the Interest on Delayed Payments Act. 14. Subsidy on ISO Certifications. 15. Subsidy on NSIC Performance and Credit ratings. 16. Participation in Govt. Purchase registrations. 17. Registration with NSIC. 18. Counter Guarantee from Govt. of India through CGSTI. 19. Waiver in Earnest Money (Security Deposit) in Govt. tenders. 20. Stamp duty and Octroi benefits. 21. 15% weightage in price Preference. 22. Reduction in rate of Interest from banks (Subject to ratings). 23. Free of Cost Govt. tenders.

For getting your MSME or any info for MSME contact 9990694230

Benefits of MSME

We help in MSME in

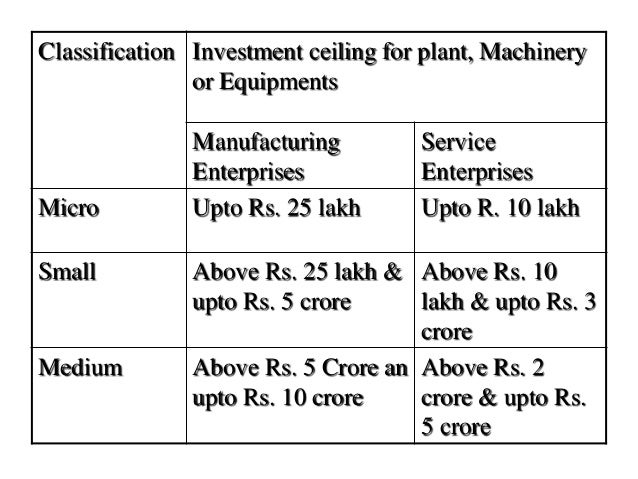

We help MSME in understanding central government schemes for MSME Is your Unit Eligible for UAM/MSME/SSI Registration All classes of enterprises, whether Proprietorship, Hindu undivided family, Association of persons, Co-operative society, Partnership firm, Company or Undertaking, by whatever name called can apply for the registration and get qualified for the benefits provided under the Act. For Enterprises engaged in the manufacture or production, processing or preservation of goods, the definition is as follows: Micro Enterprise: An enterprise where investment in plant and machinery does not exceed Rs. 25 lakh. -Small Enterprise: An enterprise where the investment in plant and machinery is more than Rs. 25 lakh but does not exceed Rs. 5 crore. Medium Enterprise: An enterprise where the investment in plant and machinery is more than Rs.5 crore but does not exceed Rs.10 crore.

For getting your MSME or any info for MSME contact 9990694230 In case of the above enterprises, investment in plant and machinery is the original cost excluding land and building and other items as specified by the Ministry of Small Scale Industries. For Enterprises engaged in providing or rendering of services, the definition is as follows: Micro Enterprise: An enterprise where the investment in equipment does not exceed Rs. 10 lakh. Small Enterprise: An enterprise where the investment in equipment is more than Rs.10 lakh but does not exceed Rs. 2 crore. Medium Enterprise: An enterprise where the investment in equipment is more than Rs. 2 crore but does not exceed Rs. 5 crore.

For getting your MSME or any info for MSME contact 9990694230

Company Secretary GAURAV SHARMA+919990694230 Connect on Watts App with Gaurav Email us [email protected] Submit your guest articles for our website click here we will publish it Subscribe our Email updates like other 100,000 Members, Free/Easy/Comfortableway

To avail the benefits under the MSMED Act from Central or State Government and the Banking Sector, MSME Registration is required. For ( )

The registration scheme has no statutory basis. Units would normally get registered to avail some benefits, incentives or support given either by the Central or State Govt.

msme small scale industries BENEFITS OF MSME/SSI REGISTRATION

1. Easy finance availability from Banks, without collateral requirement. 2. Protection against delay in payment from Buyers and right of interest on delayed payment. 3. Preference in procuring Government tenders. 4. Stamp duty and Octroi benefits. 5. Concession in electricity bills. 6. Reservation policies to manufacturing / production sector enterprises. 7. Time-bound resolution of disputes with Buyers through conciliation and arbitration. 8. Reimbursement of ISO Certification Expenses. 9. Credit prescription (Priority sector lending), differential rates of interest etc. 10. Excise Exemption Scheme. 11. Exemption under Direct Tax Laws. 12. Stamp duty and Octroi benefits. 13. Statutory support such as reservation and the Interest on Delayed Payments Act. 14. Subsidy on ISO Certifications. 15. Subsidy on NSIC Performance and Credit ratings. 16. Participation in Govt. Purchase registrations. 17. Registration with NSIC. 18. Counter Guarantee from Govt. of India through CGSTI. 19. Waiver in Earnest Money (Security Deposit) in Govt. tenders. 20. Stamp duty and Octroi benefits. 21. 15% weightage in price Preference. 22. Reduction in rate of Interest from banks (Subject to ratings). 23. Free of Cost Govt. tenders.

For getting your MSME or any info for MSME contact 9990694230

Benefits of MSME

- Processing government tender free of cost.

- Protection against delay in payment by buyer.

- Right interest delayed payment by buyer.

- Govt. Assistance in: Technology Upgradation, Raw Material, Infrastructure, Marketing.

- SEZ Benefits.

- Extended credit facilities

- Industrial extension support and services

- Availability of developed sites for warehouse construction

- Hire-purchase of machinery for use in MSME

We help in MSME in

We help MSME in understanding central government schemes for MSME Is your Unit Eligible for UAM/MSME/SSI Registration All classes of enterprises, whether Proprietorship, Hindu undivided family, Association of persons, Co-operative society, Partnership firm, Company or Undertaking, by whatever name called can apply for the registration and get qualified for the benefits provided under the Act. For Enterprises engaged in the manufacture or production, processing or preservation of goods, the definition is as follows: Micro Enterprise: An enterprise where investment in plant and machinery does not exceed Rs. 25 lakh. -Small Enterprise: An enterprise where the investment in plant and machinery is more than Rs. 25 lakh but does not exceed Rs. 5 crore. Medium Enterprise: An enterprise where the investment in plant and machinery is more than Rs.5 crore but does not exceed Rs.10 crore.

For getting your MSME or any info for MSME contact 9990694230 In case of the above enterprises, investment in plant and machinery is the original cost excluding land and building and other items as specified by the Ministry of Small Scale Industries. For Enterprises engaged in providing or rendering of services, the definition is as follows: Micro Enterprise: An enterprise where the investment in equipment does not exceed Rs. 10 lakh. Small Enterprise: An enterprise where the investment in equipment is more than Rs.10 lakh but does not exceed Rs. 2 crore. Medium Enterprise: An enterprise where the investment in equipment is more than Rs. 2 crore but does not exceed Rs. 5 crore.

FAQ

Q.1. What is the definition of MSME?

The Government of India has enacted the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 in terms of which the definition of micro, small and medium enterprises is as under:

- Enterprises engaged in the manufacture or production, processing or preservation of goods as specified below:

- A micro enterprise is an enterprise where investment in plant and machinery does not exceed Rs. 25 lakh;

- A small enterprise is an enterprise where the investment in plant and machinery is more than Rs. 25 lakh but does not exceed Rs. 5 crore;

- A medium enterprise is an enterprise where the investment in plant and machinery is more than Rs.5 crore but does not exceed Rs.10 crore.

In case of the above enterprises, investment in plant and machinery is the original cost excluding land and building and the items specified by the Ministry of Small Scale Industries vide

its notification No.S.O.1722(E) dated October 5, 2006 .

- Enterprises engaged in providing or rendering of services and whose investment in equipment (original cost excluding land and building and furniture, fittings and other items not directly related to the service rendered or as may be notified under the MSMED Act, 2006 are specified below.

- A micro enterprise is an enterprise where the investment in equipment does not exceed Rs. 10 lakh;

- A small enterprise is an enterprise where the investment in equipment is more than Rs.10 lakh but does not exceed Rs. 2 crore;

- A medium enterprise is an enterprise where the investment in equipment is more than Rs. 2 crore but does not exceed Rs. 5 crore.

Q.2. What is the support available for collateral free borrowing?

The Ministry of MSME, Government of India and SIDBI set up the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) with a view to facilitate flow of credit to the MSE sector without the need for collaterals/ third party guarantees. The main objective of the scheme is that the lender should give importance to project viability and secure the credit facility purely on the primary security of the assets financed.The Credit Guarantee scheme (CGS) seeks to reassure the lender that, in the event of an MSE unit, which availed collateral- free credit facilities, fails to discharge its liabilities to the lender, the Guarantee Trust would make good the loss incurred by the lender up to 85 per cent of the outstanding amount in default. The CGTMSE would provide cover for credit facility up to Rs. 100 lakh which have been extended by lending institutions without any collateral security and /or third party guarantees. A guarantee and annual service fee is charged by the CGTMSE to avail of the guarantee cover. Presently the guarantee fee and annual service charges are to be borne by the borrower.

Q.3. What is the support available for technology upgradation?

Ministry implements a scheme called Credit Linked Capital Subsidy Scheme (CLCSS) for technology upgradation of Micro and Small enterprises in the country. Under the scheme, 15 per cent capital subsidy, limited to maximum of Rs 15 lakh (12 per cent prior to 29.09.2005 limited to maximum of Rs 4.8 lakh) is provided to the eligible MSEs for upgrading their technology with the well-established and improved technology as approved under the scheme. 48 products/sub-sectors have been approved under the CLCSS till date. If you are an MSE manufacturing a product and want to upgrade the technology of manufacturing the product with the well established and improved technology as approved under the Scheme, then you may have to approach to the nodal agencies/eligible financial institution for sanction of term loan for purchase of eligible machinery.

Q.4. What is the support available for cluster development?

The Ministry is implementing the Micro and Small Enterprises – Cluster Development Programme (MSE-CDP) wherein support is provided for Diagnostic Study; Soft Interventions like general awareness, counseling, motivation and trust building, exposure visits, market development including exports, participation in seminars, workshops and training programmes on technology upgradaion etc; Hard Interventions ilike setting up of Common Facility Centers (Common Production/Processing Centre, Design Centre, Testing Centre etc.) and creation/upgradation of infrastructural facilities in the new/existing industrial areas/ clusters of MSEs.

Q.5. What is the support available for Skill Development?

The Ministry conducts various types of training programme through its various organisations for self employment as well as wage employment. The training programmes are primarily focused to promote self employment in the country. Thus all type of programmes have input which provide necessary information and skills to a trainee to enable him to establish his own micro or a small enterprises. The programmes include two week Entrepreneurship Development Prorgamme (EDP), Six Week Entrepreneurship Skill Development Programme (ESDP). One weak Management Development Prorgamme (MDP), One Day Industrial Motivation Campaign(IMC) etc. For Monitoring of the programme a web based system has been developed where coordinator of the programme is bound to feed all details of trainees including his photo and phone no. on the website.

Q.6. What benefits do the Tool Rooms of Ministry of MSME provide to MSMEs?

Tool Rooms are equipped with state-of-the-art machinery & equipment. They are engaged in designing and manufacturing of quality tools, which are necessary for producing quality products, and improve the competitiveness of MSMEs in national and international markets. They also conduct training programmes to provide skilled manpower to industries specially MSMEs. The placement of trainees trained in Tool Room is more than 90%. There are 18 Autonomous Bodies (10 MSME Tool Rooms and 8 Technology Development Centres) under DC (MSME).

Q.7. What support is provided by the Ministry for improving manufacturing competitiveness?

The National Manufacturing Competitiveness Programme (NMCP) is the nodal programme of the Government to develop global competitiveness among Indian MSMEs. The Programme was initiated in 2007-08. This programme targets at enhancing the entire value chain of the MSME sector through the following schemes:(a) Lean Manufacturing Competitiveness Scheme for MSMEs;(b) Promotion of Information & Communication Tools (ICT) in MSME sector;(c) Technology and Quality Up gradation Support to MSMEs;(d) Design Clinics scheme for MSMEs;(e) Enabling Manufacturing Sector to be Competitive through Quality Management Standards (QMS) and Quality Technology Tools (QTT);(f) Marketing Assistance and Technology Up gradation Scheme for MSMEs;(g) Setting up of Mini Tool Room under PPP Mode;(h) National campaign for building awareness on Intellectual Property Rights (IPR);(i) Support for Entrepreneurial and Managerial Development of SMEs through Incubators.(j) Bar Code under Market Development Assistance (MDA).

Q.8. What support is provided by the Ministry to promote energy conservation in the manufacturing process for SMEs?

The Ministry implements the “Technology and Quality Upgradation Support to Micro, Small and Medium Enterprises (TEQUP)” which focuses on two important aspects, namely, enhancing competitiveness of MSME sector through Energy Efficiency and Product Quality Certification. The basic objective of this scheme is to encourage MSMEs in adopting energy efficient technologies and to improve product quality of manufacturing in MSMEs. It is a well known fact that energy consumption is a significant component in the cost structure of almost any manufacturing/ production activity. Adopting energy efficient technologies curtails the cost of energy there by reducing production cost and increasing competitiveness. Under this scheme, a capital subsidy of 25% of the project cost subject to a maximum of Rs. 10.00 lakh shall be provided to the registered MSME units. While 25% of the project cost will be provided as subsidy by the Government of India, the balance amount is to be funded through loan from SIDBI/banks/financial institutions. The minimum contribution as required by the funding agency will have to be made by the MSME unit.

Q.9. What support is provided by the Ministry to improve quality of products produced in MSME sector?

The TEQUP scheme envisages another activity, namely, Product Quality Certification. The main objective of this scheme is to encourage MSMEs to Acquire Product Certification Licenses from National / International Bodies , thereby improving their competitiveness. The primary objective of this activity is to provide subsidy to MSME units towards the expenditure incurred by them for obtaining product certification licenses from National / International standardization Bodies. Under this Activity, MSME manufacturing units will be provided subsidy to the extent of 75% of the actual expenditure, towards licensing of product to National/International Standards. The maximum GOI assistance allowed per MSME is Rs.1.5 lakh for obtaining product licensing /Marking to National Standards and Rs. 2.0 lakh for obtaining product licensing /Marking to International standards. One MSME unit can apply only once under the scheme period.

Q.10. What support is provided by the Ministry to improve design of products produced in MSME sector?

The Ministry implements the Design Clinic Scheme for Design Expertise to Micro, Small and Medium Enterprises (MSME) Sector is to improve the design of the product to meet global challenges and compete with similar products domestically and internationally. It is launched to benefit MSMEs by creating a dynamic platform to provide expert solutions to real time Design problems and add value to existing products. The goal of this scheme is to help MSME manufacturing industries move up the value chain by switching the production mode from original equipment manufacturing to original design manufacturing and hence original brand manufacturing. In the Design Clinic scheme, the value additions to an idea or a concept are imparted through interaction at a lesser cost to a specific industry/sector.

Q.11. What support is provided by the Ministry to adopt latest Quality Management Standards and Quality Technology Tools (QMS/QTT)?

Under the National Manufacturing Competitiveness Programme (NMCP) Scheme, one component is “Enabling MSME manufacturing sector to be competitive through Quality Management Standards/Quality Technology Tools (QMS/QTT)” was initiated in the XIth Five year plan. The main objective of the scheme is to sensitize and encourage MSEs to adopt latest Quality Management Standards/Quality Technology Tools (QMS/QTT) and to keep a watch on sectoral developments by undertaking the stated activities.The major activities under the Scheme are as:a)Introduction of appropriate course modules for technical institutionsb)Organizing awareness campaigns for micro & small enterprises.c)Organising competition–watch (c-watch).d)Implementation of quality management standards and quality technology tools in selected micro & small enterprises. e)Monitoring international study missions.

Q.12. What support is provided by the Ministry for promotion of Information & Communication Tools (ICT) in MSME Sector?

The Ministry implements the Information and Communication Technology (ICT) scheme to encourage and assist Indian MSMEs to adopt ICT Tools and Applications in their production and business processes , and thereby improve their productivity and competitiveness in National and International Market.

Q.13. What support is provided by the Ministry for setting up Business Incubators ?

The Ministry implements the Support for Entrepreneurial and Managerial Development of SME’s Through Incubators”. The main purpose of the scheme is to nurture innovative business ideas (new/indigenous technology, processes, products, procedures, etc), which could be commercialized in a year. Under the Scheme, financial assistance between 75% to 85% of the project cost upto maximum of Rs. 8 lakh per idea/unit, provided to Business Incubators (BIs). The BIs are also eligible to avail Rs. 3.78 lakh for infrastructure and training expenses for incubating 10 ideas. Any individual or Micro and Small Industries (MSEs) that has innovative business idea at near commercialisation stage can approach the Business Incubators approved under the scheme. Under the scheme, various institutions like Engineering Colleges, Management Institutions, Research labs, etc. that have in-house incubation facilities and faculty for providing handholding support to new idea/entrepreneur can apply in the prescribed application form.

Q.14. What support is provided by the Ministry for setting up Business Incubators ?

The Ministry implements the Support for Entrepreneurial and Managerial Development of SME’s Through Incubators”. The main purpose of the scheme is to nurture innovative business ideas (new/indigenous technology, processes, products, procedures, etc), which could be commercialized in a year. Under the Scheme, financial assistance between 75% to 85% of the project cost upto maximum of Rs. 8 lakh per idea/unit, provided to Business Incubators (BIs). The BIs are also eligible to avail Rs. 3.78 lakh for infrastructure and training expenses for incubating 10 ideas. Any individual or Micro and Small Industries (MSEs) that has innovative business idea at near commercialisation stage can approach the Business Incubators approved under the scheme. Under the scheme, various institutions like Engineering Colleges, Management Institutions, Research labs, etc. that have in-house incubation facilities and faculty for providing handholding support to new idea/entrepreneur can apply in the prescribed application form.

Q.15. Whether there is any scheme for assisting MSMEs for Intellectual Property Rights ?

Under the National Manufacturing Competitiveness Programme (NMCP) to enhance the competitiveness of the SMEs sector, O/o DC(MSME) is implementing a scheme “Building Awareness on Intellectual Property Rights (IPR)” for the MSME. The objective of the scheme is to enhance awareness of MSME about Intellectual Property Rights (IPRs) to take measure for the protecting their ideas and business strategies. Accordingly, to enable the MSME sector to face the present challenges of liberalisation, various activities on IPR are being implemented under this scheme.

Q.16 . Is there support available for obtaining ISO certification?

The Ministry is implementing the ISO: 9001/14001/HACCP Certification Reimbursement Scheme for Micro & Small Enterprises (MSEs) for reimbursement of certification expenses, only to those MSEs which have acquired Quality Management Systems (QMS)/ISO 9001 and /or Environment Management Systems (EMS)/ ISO14001and / or Food Safety Systems (HACCP) Certification. Under the scheme provides reimbursement of 75% of the certification expenses up to a maximum of Rs.75,000/- (Rupees seventy five thousand only) to each unit as one-time reimbursement only to those MSEs which have acquired Quality Management Systems (QMS)/ISO 9001 and /or Environment Management Systems (EMS)/ ISO14001and / or Food Safety Systems (HACCP) Certification.

Q.17. What support is provided by the Ministry for enabling MSMEs to get credit rating?

The Ministry is implementing the Performance & Credit Rating Scheme, the main objective of the which is to provide a trusted third party opinion on the capabilities and creditworthiness of the MSEs so as to create awareness amongst them about the strengths and weakness of their existing operations. This is to provide them an opportunity to improve and enhance their organizational strengths and credit worthiness, so that they can access credit at cheaper rates and on easy terms. NSIC was appointed as nodal agency to implement the scheme on behalf of the Government. Rating under the scheme is being carried out through empanelled rating agencies i.e. Credit Rating Information Services of India Limited (CRISIL), Credit Analysis & Research Limited (CARE), Onicra Credit Rating Agency of India Ltd. (ONICRA), Small and Medium Enterprises Rating Agency of India Ltd. (SMERA), ICRA limited and Brickwork India Ratings. Under this Scheme, rating fee payable by the micro and small enterprises is subsidized for the first year only and that is subject to maximum of 75% of the fee or Rs. 40000/-, whichever is less.

Q.18. What support is provided by the Ministry for assisting training institutions?

The Ministry is implementing the Assisting to Training Institutions Scheme which envisages financial assistance for establishment of new institutions (EDIs), strengthening the infrastructure of the existing EDIs and for supporting entrepreneurship and skill development activities. The main objectives of the scheme are development of indigenous entrepreneurship from all walks of life for developing new micro and small enterprises, enlarging the entrepreneurial base and encouraging self-employment in rural as well as urban areas, by providing training to first generation entrepreneurs and assisting them in setting up of enterprises. The assistance shall be provided to these training institutions in the form of capital grant for creation/strengthening of infrastructure and programme support for conducting entrepreneurship development and skill development programmes.

Q.19. What support is provided by the Ministry for participation of MSMEs in international events?

Under the International Cooperation Scheme, financial assistance is provided on reimbursement basis to the State/Central Government organizations, industries/enterprises Associations and registered societies/trusts and organizations associated with MSME for deputation of MSME business delegation to other countries for exploring new areas of MSMEs, participation by Indian MSMEs in international exhibitions, trade fairs, buyer seller meet and for holding international conference and seminars which are in the interest of MSME sectors. Eligible beneficiary organizations can apply to the Ministry directly to avail the assistance under IC Scheme as per Scheme Guidelines.

Q.20. What scheme does the Ministry have for providing marketing support to MSMEs?

The Ministry implements the Marketing Assistance scheme through National Small Industries Corporation (NSIC) Limited for providing marketing support to MSMEs. The main objectives of the scheme is to enhance the marketing competitiveness of MSMEs; to provide them a platform for interaction with the individual/institutional buyers; to update them with prevalent market scenario and to provide them a form for redressing their problems. MSMEs are supported under the Scheme for capturing the new market opportunities through organising/ participating in various domestic & international exhibitions/ trade fairs, Buyer-Seller meets intensive-campaigns and other marketing events.

Q.21. Does the Ministry have any scheme for providing handholding support and assistance to potential entrepreneurs?

The Ministry implements the Rajiv Gandhi Udyami Mitra Yojana (RGUMY), objective of which is to provide handholding support and assistance to the potential first generation entrepreneurs, who have already successfully completed Entrepreneurship Development / Skill Development Training. Selected lead agencies i.e ‘Udyami Mitras’, provide information and guidance to first generation entrepreneurs regarding various promotional schemes of the Government, procedural formalities required for setting up and running of the enterprises and help them in accessing Bank credit etc. A ‘Udyami Helpline’ (a Call Centre for MSMEs) with a toll free No. 1800-180-6763 has also been set up to assist the entrepreneurs.KEY WORDSCredit Guarantee Capital Subsidy Cluster Development Skill DevelopmentTool Rooms Manufacturing Competitiveness Lean Manufacturing Design Clinics Quality Management Standards (QMS) Quality Technology Tools (QTT);Marketing Assistance on Intellectual Property Rights (IPR); Business IncubatorsBar Code Energy ConservationISO certificationCredit RatingInternational Cooperation Marketing Marketing Assistance

For getting your MSME or any info for MSME contact 9990694230

Company Secretary GAURAV SHARMA+919990694230 Connect on Watts App with Gaurav Email us [email protected] Submit your guest articles for our website click here we will publish it Subscribe our Email updates like other 100,000 Members, Free/Easy/Comfortableway